3 Keys to Home Ownership

Learn how to get the best rate and the lowest payment!Key #1 – Work History

Lender require a source of income sufficient to pay of your new mortgage. For the vast majority of individuals, that income comes from a job. Income from retirement, alimony, or child support can also be considered when qualifying.

Good: Having a Job

All loan programs require a source of income; generally from a job.

Better: A Two-Year Job History

Most loans require a two-year work history. Sometimes we can patch together multiple jobs and schooling and even church missions to get to two years, when applicable. It is best to avoid big gaps in your employment history.

Best: A Two-Year Job History In The Same Line Of Work

Having a solid two-year job history in the same line of work with the same pay structure (e.g., salary vs. commission) is most likely to qualify you for a loan. Some loan programs require your work to be in the same field; others are more flexible.

Good: 640

A score of 640 or better qualifies for almost all loan programs. Limited options are available for scores between 580 and 640.

Better: 720

Scores over 720 offer better loan terms and lower payments.

Best: 760+

Credit score that are 760 and better prove that you have good money management practices and that results in the least expensive loan possible.

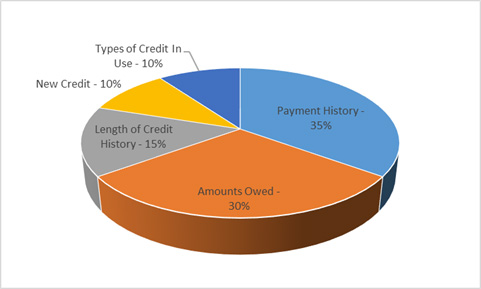

THE 5 BIGGEST CREDIT FACTORS

Your payment history is the biggest factor that effects your score. Paying all your bills on time and keeping your report free from collections and judgments helps keep your score up. The second biggest factor has to do with the amount you owe in relation to your available credit. Keep your revolving credit balances low to keep your credit score high!

Good: 3.5% Down Payment

3.5% down qualifies you for an FHA loan. FHA loans are a good choice if you have a small down payment or a low credit score. FHA loans have upfront mortgage insurance and monthly mortgage insurance for the life of the loan.

Better: 5% Down Payment

5% down qualifies you for a conventional loan. Conventional loans don’t have upfront mortgage insurance but they do require you to pay for monthly mortgage insurance until you reach 20% equity in the home.

We also have some conventional loan programs for qualified borrowers that allow for only 3% down!

Best: 20% Down Payment

20% down qualifies you for a conventional loan without mortgage insurance. This is the best possible scenario when financing a home.

We also offer VA and USDA loans which can be done with zero down!

If a down payment is impossible, we work with different grants and down-payment assistance programs that can minimize your need to bring money to the table. Note that these programs often have higher rates and fees than a traditional loan. Most home purchase transactions will require you to pay an earnest money deposit that’s generally $500 to $1,000. Earnest money will have to be provided before and outside the home loan process but can count towards your down payment.